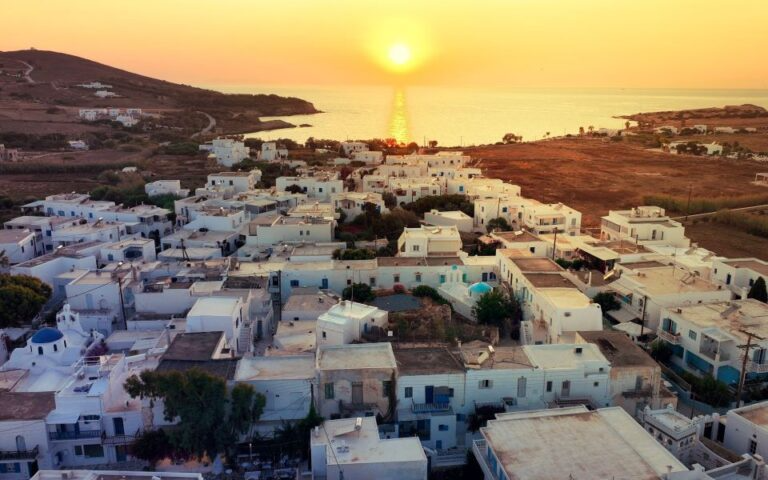

Travel receipts reached 589.7 million euros in the first two months of 2024, making a dynamic start to the year, with an increase of 24.5% compared to the same month last year (457.5 million euros). According to Bank of Greece data, non-resident travel arrivals also increased by 20.7% compared to the first two months of 2023.

- In February 2024, the current account deficit increased year-on-year, due to a deterioration in the balance of goods and the primary and secondary income accounts, while the balance of services improved.

- In January-February 2024, the current account registered a slight improvement year-on-year, owing to an improvement in the secondary income account and, to a lesser extent, in the balance of services, which was partly offset by a worsening in the balance of goods and the primary income account.

CURRENT ACCOUNT

In February 2024, the current account deficit recorded an increase of €1.8 billion year-on-year and stood at €3.2 billion. The deficit of the balance of goods widened, as exports decreased and imports increased. At current prices, exports dropped by 10.3% (‑10.7% at constant prices) and imports grew by 5.7% (9.4% at constant prices). Specifically, non-oil goods exports at current prices fell marginally by 0.7% (‑3.2% at constant prices), while the corresponding imports increased by 10.7% (11.8% at constant prices). The services surplus increased slightly due to an improvement across all its sub-components. Compared with February 2023, non-residents’ arrivals rose by 26.0% and the relevant receipts grew by 22.2%. The primary income account registered a deficit, against a surplus in the corresponding month of 2023, as net receipts from other primary income decreased and net interest, dividend and profit payments increased.

The secondary income account recorded a deficit, against a surplus in February 2023, as general government registered net payments instead of net receipts. In January-February 2024, the current account deficit fell by €41.5 million year-on-year and stood at €1.5 billion. The goods deficit grew, reflecting a drop in exports and an increase in imports. At current prices, exports decreased by 10.3% (‑17.6% at constant prices) and imports grew by 1.1% (1.2% at constant prices). More specifically, non-oil goods exports at current prices declined by 4.5%, while the corresponding imports increased by 5.9% (‑14.5% and 1.4% at constant prices, respectively).

The services surplus widened, due to an improvement in the other services balance and, to a lesser extent, the travel and transport balances. Compared with January-February 2023, non-residents’ arrivals rose by 20.7% and the relevant receipts grew by 24.5%. The primary income account deficit deteriorated markedly compared with January-February 2023, mainly due to lower net receipts of other primary income. The secondary income account surplus increased during the same period year-on-year, mainly as a result of higher net receipts of the other sectors of the economy excluding general government.

CAPITAL ACCOUNT

In February 2024, the capital account showed a deficit, against a surplus in the corresponding month of 2023, and stood at €149.5 million, reflecting net payments, instead of net receipts, in the other sectors of the economy excluding general government, and lower net receipts in general government. In January-February 2024, the capital account showed a deficit against a surplus in the corresponding period of 2023, standing at €316.4 million, mainly due to a decrease in general government net receipts.

COMBINED

In February 2024, the deficit of the combined current and capital account (corresponding to the economy’s external financing requirements) increased significantly against February 2023 and stood at €3.3 billion. In January-February 2024, the combined current and capital account registered a deficit, against a surplus in the corresponding period of 2023, standing at €1.8 billion.

FINANCIAL ACCOUNT

In February 2024, direct investment saw net flows of €41.1 million under residents’ external assets and net flows of €480.5 million under residents’ external liabilities, without any notable transactions. Under portfolio investment, an increase in residents’ external assets is almost exclusively attributable to a rise of €986.0 million in residents’ holdings of foreign bonds and Treasury bills. An increase in their liabilities is mainly due to a rise of €3.0 billion in non-residents’ holdings of Greek bonds and Treasury bills.

Under other investment, residents’ external assets dropped due to a decline of €997.0 million in residents’ deposit and repo holdings abroad, which was partly offset by a €661.0 million statistical adjustment associated with the issuance of banknotes.

An increase in residents’ external liabilities reflects chiefly a rise of €1.1 billion in non‑residents’ deposit and repo holdings in Greece (including the TARGET account) and a €661.0 million statistical adjustment associated with the issuance of banknotes, which were offset, to a degree, by a decline of €1.4 billion in the outstanding debt to non‑residents. In January-February 2024, direct investment showed a €284.5 million flow under residents’ external assets and a €856.1 million flow under residents’ external liabilities, representing non‑residents’ direct investment in Greece. Under portfolio investment, a rise in residents’ external assets is almost exclusively due to an increase of €1.3 billion in residents’ holdings of foreign bonds and Treasury bills.

An increase in their liabilities mainly reflects a rise of €5.0 billion in non‑residents’ holdings of Greek bonds and Treasury bills. Under other investment, a drop in residents’ external assets is mainly due to a decline of €2.6 billion in residents’ deposit and repo holdings abroad and, to a lesser extent, a €1.3 billion statistical adjustment associated with the issuance of banknotes.

A decline in their liabilities is mainly associated with a decrease of €4.2 billion in non‑residents’ deposit and repo holdings in Greece (the TARGET account included) and, to a lesser extent, a decline of €1.7 billion in the outstanding debt to non‑residents and a €1.3 billion statistical adjustment related to the issuance of banknotes. At end-February 2024, Greece’s reserve assets stood at €12.4 billion, compared with €11.8 billion at end-February 2023. Note: Balance of payments data for March 2024 will be released on 21 May 2024.