EUROBANK

Eurobank, which, through its Luxembourg branch, is increasing its share in the wealth management market, is integrating all of the group's private banking activities.

14/02/25 • 08:47

Eurobank announced the completion of the acquisition of an additional 37.6% stake in Hellenic Bank for a price of EUR 750 million. Following the transaction, its total stake amounts to 93.47% of Hellenic Bank

12/02/25 • 10:44

Eurobank has received approval for the disbursement of the eighth tranche of the Recovery & Resilience Fund (RDF), amounting to €300 million of resources, from the Ministry of Economy and Finance, having met the required targets under the Operational Agreement signed with the Greek State.

04/02/25 • 11:05

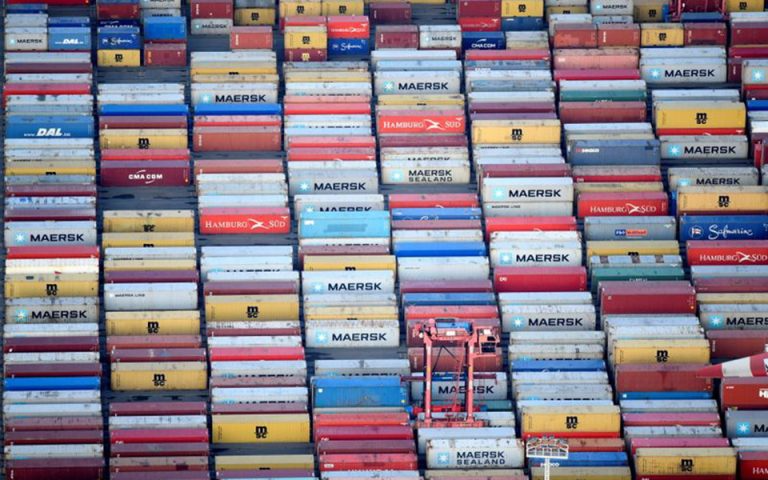

The current issue of Eurobank's 7 Days Economy newsletter explores the impact of Donald Trump's tariffs on Greek exports and the potential changes in our country's trade with the US as a result of the White House transition.

23/01/25 • 18:43

According to a statement by Eurobank, the total amount of the transaction amounts to approximately €186 million. Settlement of the transaction is expected to be completed on or around 27 January 2025.

23/01/25 • 12:20

A placement for up to 2.2% of Eurobank, or 80 million shares, was made by major shareholder Prem Watsa (Fairfax).

23/01/25 • 08:31

Eurobank exits the markets through Tier II maturity of 10.5 years and non-call at five years.

21/01/25 • 12:17

After a year in which Greek equities have broadly performed in line with those of the EU region, 2025 looks somewhat more challenging, given international headwinds (e.g. tariffs, geopolitics), according to a report by Eurobank Equities.

20/01/25 • 08:38

The sale of Demetra Holdings' 8.58% stake in Logicom has been completed, according to an announcement by Eurobank, with the price amounting to approximately €27 million.

17/01/25 • 12:31