AADE

At HoReCa, the annual international exhibition that is a meeting point for professionals in tourism, catering and hospitality equipment, and in particular at the Business Lab of the event, participated the Governor of the Independent Authority for Public Revenues, George Pitsilis.

10/02/25 • 17:00

The Governor of the Independent Authority for Public Revenues (AADE), George Pitsilis, referred to the tangible results of the effort to tackle tax evasion in 2024.

22/01/25 • 12:42

The AADE presents the assessment of the actions for 2024. As it states, further deepening the digitalisation of the organisation and organisational transformation, with centralisation of services and adoption of new, flexible service models, were the core of the projects and actions of the Independent Public Revenue Authority in 2024.

08/01/25 • 12:18

The Independent Public Revenue Authority (AADE) presents the Strategic Plan for the period 2025-2029, stressing that it is a plan of high objectives that sets the basis for a model and technologically advanced administration, meets the modern needs of citizens and businesses, while ensuring public revenues and supporting the implementation of fiscal and social policy.

03/01/25 • 11:18

Duration is the main criterion for when a rental is classified as short-term and treated as "Airbnb" for tax purposes or long-term and classified as tourist accommodation.

03/01/25 • 10:25

In 2022, the total VAT revenue was €18.621 billion in Greece. The VAT compliance gap was estimated at €2,959 million, or 13.7% of the total VAT tax liability (VTTL), a decrease of 3.8 percentage points compared to 2021.

18/12/24 • 18:21

The benefits of the consolidation of tax and customs services under one organisation, the model of the Independent Public Revenue Authority, were mentioned by Governor George Pitsilis, speaking at the international conference organised by the Saudi Arabian Tax Administration in Riyadh.

05/12/24 • 12:28

Eight are the modern challenges facing tax administrations today, which the Governor of the Independent Public Revenue Authority, Giorgos Pitsilis, referred to during his introductory speech at the 17th Conference of OECD tax administrations, which began this morning in Athens.

13/11/24 • 12:56

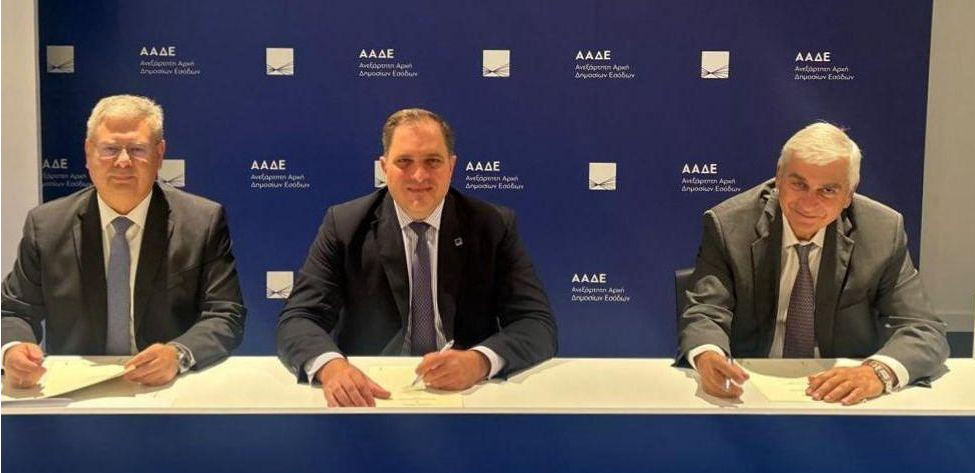

Giorgos Pitsilis, Governor of the Independent Authority for Public Revenue, and representatives of Hellenic Energy (Hellenic Petroleum) and Motor Oil Hellas signed a Memorandum of Cooperation today.

11/11/24 • 14:26

Prime Minister Kyriakos Mitsotakis inaugurated the new digital headquarters of the Independent Authority for Public Revenue (AADE).

29/10/24 • 12:35

The Independent Public Revenue Authority, in cooperation with the Ministry of Digital Governance, is introducing a new digital procedure for the submission of agreements for the commissioning of technical works over 6,000 euros by a contractor or subcontractor, starting from 1/11, with the creation of a special digital application, Gov.gr.

24/10/24 • 16:52